Roth 401k compound interest calculator

Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month.

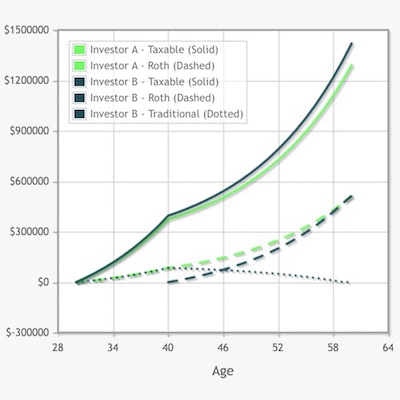

Roth 401k Might Make You Richer Millennial Money

The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance.

. The Sooner You Invest the More Opportunity Your Money Has To Grow. For 2022 the maximum annual IRA. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Ad Explore Your Choices For Your IRA. A 401 k match is an employers percentage match of a participating employees contribution to their 401 k plan usually up to a certain limit denoted as a percentage of the employees. How to Calculate Compounded Interest in a Roth IRA.

Choose the appropriate calculator below to compare saving in a 401k account vs. You can easily perform this calculation using our Compound Interest Calculator Roth IRA. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Get Up To 600 When Funding A New IRA. Official Site - Open A Merrill Edge Self-Directed Investing Account Today. Compare 2022s Best Gold IRAs from Top Providers.

Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Ad Explore Your Choices For Your IRA. Ad Strong Retirement Benefits Help You Attract Retain Talent.

Ad Dont Pay Taxes When You Withdraw Your Money After You Retire. A 401 k can be one of your best tools for creating a secure retirement. To get the most out of this 401 k calculator we recommend that you input data that reflects your retirement goals and current financial situation.

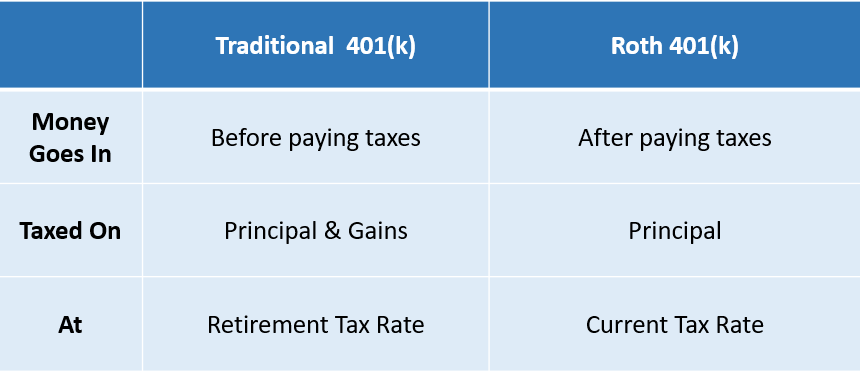

As of January 2006 there is a new type of 401 k contribution. Wed suggest using that as your primary retirement account. It provides you with two important advantages.

Income tax bracket accumulation phase 0 to 75 Taxation of contribution options. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. Discover Fidelitys Range of IRA Investment Options Exceptional Service.

Get Up To 600 When Funding A New IRA. If you have a 401k or other retirement plan at work. First all contributions and earnings to your 401 k are tax deferred.

Traditional 401 k and your Paycheck. Whether you participate in a 401 k 403 b or 457 b program. Mortgage Loan Auto Loan.

Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You. Traditional IRA calculator and other 401k calculators to help consumers determine the best option for retirement savings.

Not everyone is eligible to contribute this. Download 99 Retirement Tips. Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement.

Official Site - Open A Merrill Edge Self-Directed Investing Account Today. Ad Tip 83 recommends rolling over your 401k. Open a Roth IRA Account.

This tool compares the hypothetical results of investing in a Traditional pre-tax and a Roth after-tax retirement plan. If you dont have data ready. A 401 k can be an effective retirement tool.

An investment calculator is a simple way to estimate how your money will grow if you keep investing at the rate youre going right now. This calculator assumes that you make your contribution at the beginning of each year. Roth 401 k contributions allow.

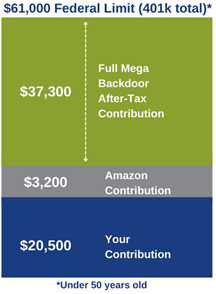

Heres a comparison of one deposit of 1000 and different rates of compounding interest even if you didnt continue to add to the Roth IRA account. The amount you will contribute to your Roth IRA each year. You can contribute up to 20500 in 2022 with an additional 6500 as a.

Reviews Trusted by Over 45000000. 1 Traditional 401 k deductible account fully funded contributions to Roth 401 k non. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly.

But rememberan investment calculator doesnt.

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

Can I Afford To Save For Retirement

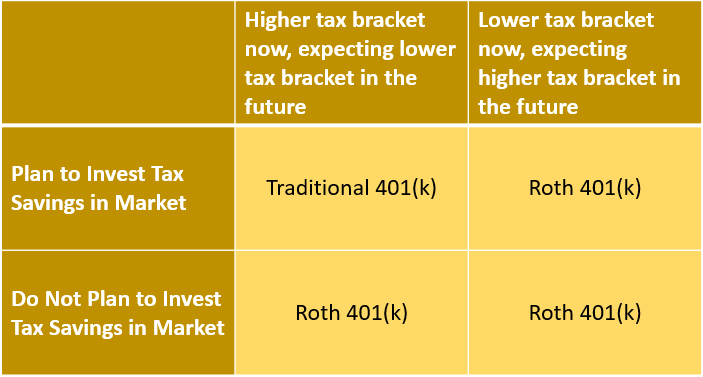

Traditional Vs Roth 401 K Which One Should You Choose

Can I Afford To Save For Retirement

5 Times A Roth 401k Conversion Is A Good Idea Above The Canopy

Calculators Dr Breathe Easy Finance Budgeting Finances Budgeting Finance

Ramit Sethi Saving Plan Photography Business Software Money Financial Life Solutions

Vanguard Consider The Advantages Of Roth After Tax Contributions

Traditional Vs Roth 401 K Which One Should You Choose

Compound Interest Formula Explained Compound Interest Compound Interest Investments Math Methods

Roth Ira So Let S Say You Put Away The Maximum 5 500 Each Year And Continue To Put Away That Amount Adjusted For Inflation Wealth Building Roth Ira Wealth

Traditional Vs Roth 401 K Which One Should You Choose

Personal Finance Archives Ubiquity

All You Need To Know About 401k Dr Breathe Easy Finance Finance Investing Investment Quotes Investing

Amazon S 401k Roth Conversion Avier Wealth Advisors

Personal Finance Archives Ubiquity

Roth 401k Roth Vs Traditional 401k Fidelity